To arrive at the total deductions in your salary: Gross Salary = CTC – Bonus = ₹7.5 lakhs – ₹50,000 = ₹7 lakhs Your monthly in-hand salary is the actual amount that remains after taking away all the deductions from your gross salary.įor instance, if your CTC is ₹7.5 lakhs and the company pays you ₹50,000 as a bonus each year, then your Many folks rely on a salary calculator in India to overcome this hurdle. If you’re still feeling confused, you’re not alone. Calculating your in-hand salary can be quite tricky because of all the different components. We hope the above breakdown of your salary components gave you sufficient information to get started. It’s a direct tax you need to pay to the state government and the maximum amount payable is ₹ 2,500 per year. The contribution you make towards the EPF is eligible for a deduction under Section 80C of the Income Tax Act, 1961. It’s a performance-based incentive given by your employer that’s part of your gross salary and fully taxable.Įmployee contribution to the provident fund (EPF)īoth you and your employer each contribute 12% of your basic salary each month to the EPF (Employee Provident Fund). It is a fully taxable component of your salary.

It’s a fixed amount given over and above your basic salary for meeting certain requirements and varies across companies.

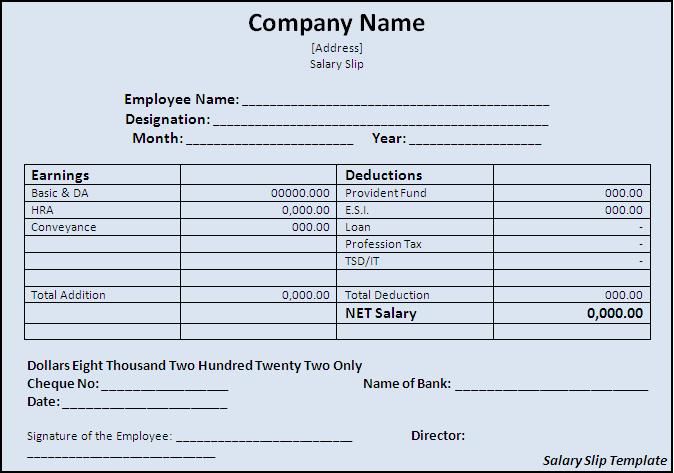

This is an allowance given by your employer for domestic travel while you are on leave and is exempt from income tax as per the Income Tax Act 1961. It is a fully taxable component of your salary if you do not live in a rented house. This is the benefit given towards expenses related to rented accommodation. It varies between 35-50% of your total gross salary depending on your designation, experience, and the industry you work in. It is the base amount of your salary package. However, gratuity can be paid before 5 years in case of the death of an employee or they become disabled due to an accident or illness. Eligibility to receive gratuity is dependent on the fact that you should have completed at least 5 years in an organisation. Gratuity is the monetary benefit given by your employer in return for your services. Gross salary includes your basic salary, house rent allowance (HRA), provident fund, leave travel allowance (LTA), medical allowance, Professional Tax etc. Gross salary is your salary before any deductions are made from it. Before we get started, here are a few salary-related terms you need to know:ĬTC (Cost to Company) is your total salary package that includes all benefits spent on you by the company without any tax deductions. The salary amount is usually mentioned in your offer letter or you can find it in your payslip as well.ĭo you find your salary slip confusing? Allow us to break it down for you.

Salary is the fixed amount of money every professional employee gets for their work at the end of each month (don’t you eagerly look forward to this day each month?).

0 kommentar(er)

0 kommentar(er)